Winners fashion increased in low individuals in the first quarter. How difficult is the mid -range women’s clothing?

5 min read

Interface News reporter |

Interface News Edit | Xu Yue

Women’s Group Women’s Women’s Women’s Women’s Women’s Women’s Group has disclosed the quarterly operating performance in the single quarter since 2024.The company has 8 mid -to -high -end women’s clothing brands including Koradior, Naersi, NEXY.CO (Nache).

Winners fashion disclosure, in the first quarter of 2024,Koradior brand flow (product sales) recorded lower single digits year -on -year.Naersi and nexy.co recorded the growth of medium digits and high single digits, respectively.These three major brands are the main brand of winners, with a total contribution of about 70 % of revenue.The total number of other five brands of water recorded low single digits.Winners’ overall flow also achieves low single -digit growth.

According to Shen Wanhongyuan’s research report, the data released by winner fashion at the telephone meeting, the first quarter of the winner fashion reached 1.7 billion yuan.Among them, the main brandKoradior dropped by 3%, mainly because the brand closed some low -quality stores in the first quarter; Naersi and andNEXY.CO records 5%and 9%growth respectively;La KOORADIOR and emerging brand FUUNNY FEELLN recorded two -digit growth of 17%and 21%respectively; and Elsewhere, Cadidl, and Naersiling have decreased by medium -volume brands with a size of 4.5 billion yuan.

Shen Wanhongyuan pointed out that the performance of winner fashion in the first quarter of 2024 is in line with expectations -when the high base in January and February, the weather affects the seasonal demand for the spring in March, and the return of franchiseesGrowth.

But compared with the past, the winner’s fashion seems to have a slowdown in growth.For reference, the growth rate of winner fashion and clothing retail.In the first quarter of 2024, the total retail sales of consumer goods in clothing, hats and needle textiles increased by 2.5%year -on -year, which was equivalent to the low -digit number of winners.

In the first half of 2023, the winner fashionThe overall increase was 15.26%, and the same period was wonThe total retail sales of consumer goods in clothing, hats, and needle textiles increased by 12.8%;In the first half of 2019, the winner fashion has not acquired brands such as Naersi. The increase of the three self -owned brands Koradior, La Koradior and Elsewhere are between 8%and 19%, which is much higher than the same period than the same period.Growth of 3%of the total retail sales of consumer goods in clothing, hats, and needle textiles, and needle textilesEssence

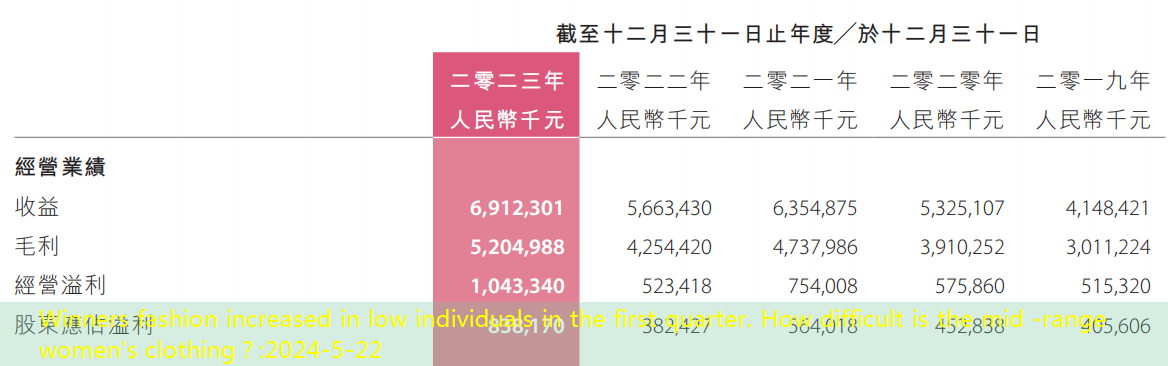

For companies such as winner fashion -winner fashion revenue increased from 1.037 billion yuan in 2014 to 6.912 billion yuan in 2023, with an average annual compound growth rate of 23.5%.Where is the space that continues to grow, it is always worthy of attention.

Judging from the information disclosed by Winners Fashion at the 2023 performance conference, its future growth points will increase from existing brands (not the growth of the number of stores), and the introduction of eight brands outside the existing eight brands.New brand.

The goal of winner fashion is to double the efficiency of the store in the next three years, and the growth of store effects mainly comes from the improvement of commodity power and the optimization of channels.In 2023, the efficiency of the winner fashion direct business stores increased by 28%year -on -year, and also increased by 13%over 2021.

Winning Fashion said at the aforementioned performance meeting that winner fashion resumed the company’s development in the past ten years in 2021 and 2022. He realized that there were shortcomings in the commodity system, so he focused on this optimization in the past few years.Including the improvement of digital facilities, providing big data support for product development and feedback; providing more products that cover users’ daily life scenes; in conjunction with the improvement of the supply chain, further enhance the quality ratio of the product.

It is worth mentioning that winner fashion said that the price of the previous brand’s products is very high, resulting in a high promotion cost, and the actual price is always lower than the tag price; and today’s goal is to rely on increasing the quality price to improve daily life to improve daily life.Sale.This is why winners fashion believes that the gross profit margin of the company in the future may not necessarily be higher, but the profit margin will continue to be optimized.

The optimization of channels is mainly two points: opening a big shop and opening a good shop. “Good shops” mainly refer to the good store location.In addition, compared with the opening of the new store, winner fashion has focused on the optimization of existing stores in the past two years.In 2023, the number of winners of the next stores of winners decreased by 42 to 1964, of which 361 stores with more than 200 square meters or more, accounting for 24%of direct -operated stores.

Winner Fashion stated at the aforementioned performance meeting that the area of offline stores in 2023 increased by nearly 10%. In 2024, the growth of the store area will continue to continue this trend.There are expectations.

In the introduction of new brands, winner fashion has shifted to the existing international brand to find the “suitable for the development of the Chinese market”, and plans to develop new brands by joint venture, trademark authorization and even acquisition.At present, the winner fashion is being negotiated with a new brand, only revealing the new brandIt will provide men’s and women’s clothing, “meet the demand for cross -scene clothing for high net worth individuals for sports leisure and business commuting.”It is expected to be listed in the first quarter of 2025.

Cheng Weixiong, an independent analyst of the fashion industry and the founder of Shanghai Liangqi Brand Management Co., Ltd., believes that the multi -brand fashion group like winner fashion, due to the resource sharing of product development and supply chain, it is difficult for its brands to make real differentiation.There are even competition between the internal brands of the group.Therefore, under the leadership of strong main brands, the second, third, and other deputy brands are difficult to grow into the main force.